A nursing strike in London in December. A new two-day walkout by nursing staff over pay began Wednesday

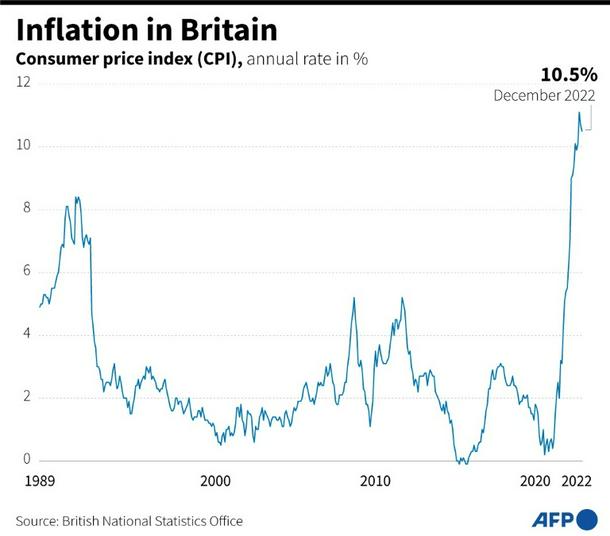

London (AFP) - Annual inflation in Britain slowed to 10.5 percent in December, official data showed Wednesday, but remained close to historically high levels that are causing a cost-of-living crisis and mass strikes.

The Consumer Prices Index (CPI) rate compared with 10.7 percent in November, the Office for National Statistics said in statement.

“Inflation eased slightly in December, although still at a very high level, with overall prices rising strongly during the last year as a whole,” said ONS chief economist Grant Fitzner.

He noted that petrol prices “fell notably in December, with the cost of clothing also dropping back slightly”.

“However, this was offset by increases for coach and air fares as well as overnight hotel accommodation,” Fitzner added.

Chart on British Consumer Prices Index (CPI), which slowed to 10.5 percent in December

UK inflation began soaring last year amid sharp price rises worldwide due to supply constraints caused by Russia’s invasion of Ukraine and the lifting of Covid pandemic lockdowns.

Britain was also hit by fallout from Brexit, which has increased the cost of doing business across a range of sectors.

Consumer inflation reached 11.1 percent in October, the highest level since 1980.

Official data Tuesday revealed that average British wages sank 2.6 percent at the end of last year as pay rises failed to keep pace with inflation, triggering major strike action.

While some striking workers have managed to agree new pay deals, tens of thousands of workers across the private and public sectors continue to stage walkouts.

Nurses in England on Wednesday began two days of strikes, with officials warning of disruptions for thousands of patients in the UK’s state-run health service.

Nurses are also set to join teachers and railway workers in further stoppages at the start of February.

It comes as the Conservative government seeks to limit strikes with controversial legislation, arguing that increasing pay will hinder efforts to cool inflation.

- ‘Difficult decisions’ -

Welcoming December’s dip in inflation, finance minister Jeremy Hunt said it was “vital” the government took “the difficult decisions needed” to reduce prices further.

“High inflation is a nightmare for family budgets, destroys business investment and leads to strike action, so however tough, we need to stick to our plan to bring it down,” he said in a statement.

The main policy used to cool inflation is the raising of interest rates by central banks.

The Bank of England and its peers are forecast to keep increasing borrowing costs this year but by less than the aggressive amounts seen in 2022.

“Falling inflation will come as a relief to Bank of England policymakers who may see this as an opportunity to slow the pace of further rate rises,” Yael Selfin, chief economist at KPMG UK, said in reaction to Wednesday’s data.